Sales And Use Tax Form Texas . texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. how to file a texas sales and use tax return. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. texas sales and use tax exemption certification. Understand that i will be liable for payment of all. This certificate does not require a number to be valid. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas sales and use tax forms. If you own a business in texas that sells products or provides.

from www.pdffiller.com

This certificate does not require a number to be valid. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. If you own a business in texas that sells products or provides. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas sales and use tax forms. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. texas sales and use tax exemption certification. how to file a texas sales and use tax return. Understand that i will be liable for payment of all.

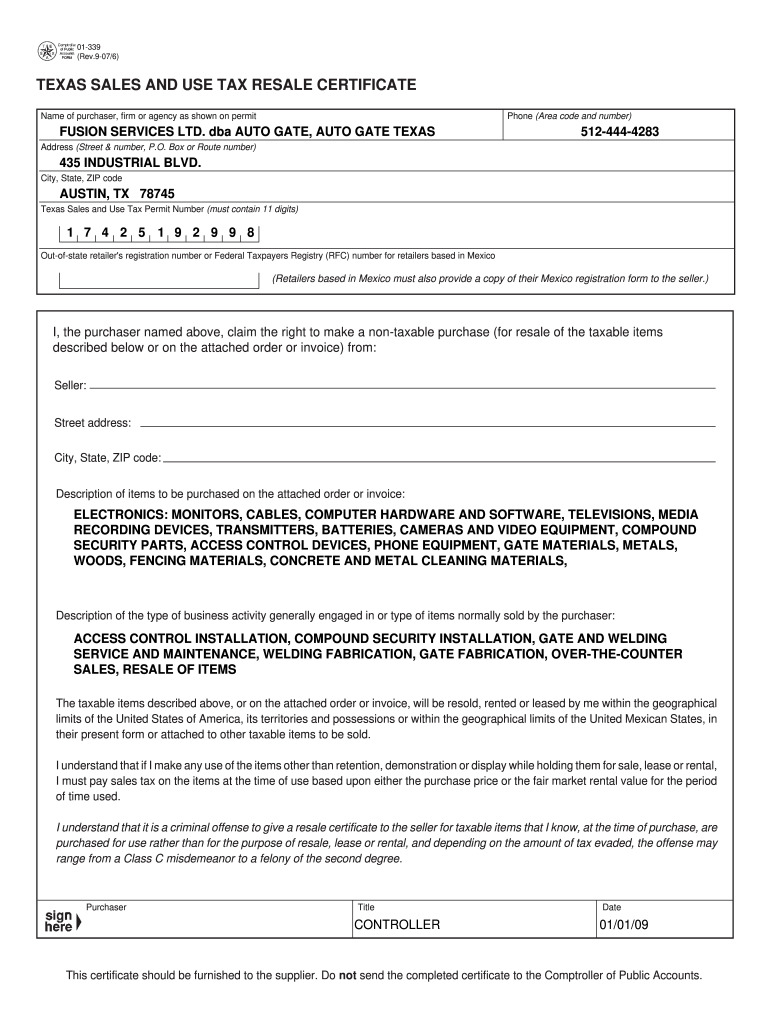

Fillable Online Texas sales and use tax resale certificate Compound Security Fax Email

Sales And Use Tax Form Texas If you own a business in texas that sells products or provides. This certificate does not require a number to be valid. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. texas sales and use tax exemption certification. how to file a texas sales and use tax return. Understand that i will be liable for payment of all. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you own a business in texas that sells products or provides. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. texas sales and use tax forms.

From tramiteseeuu.com

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que tienes que saber Sales And Use Tax Form Texas how to file a texas sales and use tax return. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. Understand that i will be liable for payment of all. If you do not file electronically, please use the preprinted forms we mail to. Sales And Use Tax Form Texas.

From studylib.net

Sales and Use Tax Return Form Sales And Use Tax Form Texas texas sales and use tax forms. texas sales and use tax exemption certification. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. how to file a texas. Sales And Use Tax Form Texas.

From www.formsbank.com

Fillable Form Ap201 Texas Application For Sales Tax Permit And/or Use Tax Permit printable Sales And Use Tax Form Texas texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. This certificate does not require a number to be valid. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. Understand that i will be liable for payment of. Sales And Use Tax Form Texas.

From www.formsbank.com

Fillable Form 69315 Texas Certificate Of Tax Exempt Sale printable pdf download Sales And Use Tax Form Texas If you own a business in texas that sells products or provides. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable.. Sales And Use Tax Form Texas.

From www.formsbank.com

Form 01114 Texas Sales And Use Tax Return printable pdf download Sales And Use Tax Form Texas texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. texas sales and use tax exemption certification. how to file a texas sales and use tax return. Understand that i will be liable for payment of all. If you do not file electronically,. Sales And Use Tax Form Texas.

From www.formsbank.com

Top 33 Texas Sales Tax Form Templates free to download in PDF format Sales And Use Tax Form Texas If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you own a business in texas that sells products or provides. texas sales and use tax forms. Understand that i will be liable for payment of all. texas imposes a 6.25 percent state sales and use tax on all retail sales,. Sales And Use Tax Form Texas.

From printableformsfree.com

Texas Resale Form Fillable Printable Forms Free Online Sales And Use Tax Form Texas If you do not file electronically, please use the preprinted forms we mail to our taxpayers. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. Understand that i will be liable for payment of all. texas sales and use tax exemption certification. texas sales. Sales And Use Tax Form Texas.

From evausacollection.com

Texas Sales Tax Certificate.jpg Eva USA Sales And Use Tax Form Texas This certificate does not require a number to be valid. Understand that i will be liable for payment of all. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you own a business in texas that sells products or provides. texas sales and use tax exemption certification. how to file. Sales And Use Tax Form Texas.

From www.exemptform.com

Fillable Form 01 339 Back Texas Sales And Use Tax Exemption Sales And Use Tax Form Texas This certificate does not require a number to be valid. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. how to file a texas sales and use tax return. If you do not file electronically, please use the preprinted forms we mail to our taxpayers.. Sales And Use Tax Form Texas.

From www.youtube.com

FAQ Is there a difference between a Resale Certificate and a Sales and Use Tax Permit in Texas Sales And Use Tax Form Texas texas sales and use tax exemption certification. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you own a business in texas that sells products or provides. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. This. Sales And Use Tax Form Texas.

From www.uslegalforms.com

TX Comptroller 01315 19912021 Fill out Tax Template Online US Legal Forms Sales And Use Tax Form Texas texas sales and use tax exemption certification. This certificate does not require a number to be valid. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. sales tax is a tax paid to state and local tax authorities in texas for the. Sales And Use Tax Form Texas.

From www.uslegalforms.com

TX TREC 322 20082021 Fill and Sign Printable Template Online US Legal Forms Sales And Use Tax Form Texas how to file a texas sales and use tax return. texas sales and use tax exemption certification. This certificate does not require a number to be valid. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. If you own a business in texas that. Sales And Use Tax Form Texas.

From www.uslegalforms.com

Texas Sales And Use Tax Permit Fill and Sign Printable Template Online US Legal Forms Sales And Use Tax Form Texas If you own a business in texas that sells products or provides. This certificate does not require a number to be valid. how to file a texas sales and use tax return. texas sales and use tax forms. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas imposes a. Sales And Use Tax Form Texas.

From exolwrmuq.blob.core.windows.net

Texas Sales And Use Tax Form 01339 at Henry Cook blog Sales And Use Tax Form Texas texas sales and use tax exemption certification. how to file a texas sales and use tax return. If you own a business in texas that sells products or provides. Understand that i will be liable for payment of all. This certificate does not require a number to be valid. texas sales and use tax forms. sales. Sales And Use Tax Form Texas.

From www.templateroller.com

Form 01114 Fill Out, Sign Online and Download Fillable PDF, Texas Templateroller Sales And Use Tax Form Texas This certificate does not require a number to be valid. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you own a business in texas that sells. Sales And Use Tax Form Texas.

From www.uslegalforms.com

TX Sales Tax Return Quarterly Form Denver City & County Fill out Tax Template Online US Sales And Use Tax Form Texas If you do not file electronically, please use the preprinted forms we mail to our taxpayers. This certificate does not require a number to be valid. texas sales and use tax exemption certification. If you own a business in texas that sells products or provides. how to file a texas sales and use tax return. texas imposes. Sales And Use Tax Form Texas.

From www.pdffiller.com

Fillable Online Texas sales and use tax resale certificate Compound Security Fax Email Sales And Use Tax Form Texas If you own a business in texas that sells products or provides. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. sales tax is a tax paid. Sales And Use Tax Form Texas.

From www.pdffiller.com

Fillable Online texas sales tax exemption form Fax Email Print pdfFiller Sales And Use Tax Form Texas If you own a business in texas that sells products or provides. sales tax is a tax paid to state and local tax authorities in texas for the sale of certain goods and services. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable.. Sales And Use Tax Form Texas.